EU Privacy Token Ban: What It Signals for Cyprus and Crypto Forensics

May 21, 2025

A New Era of AML Oversight in Crypto

The European Union has finalized a sweeping Anti‑Money Laundering Regulation (AMLR) set to take effect in 2027, targeting anonymous crypto‑asset accounts and privacy‑preserving tokens like Monero (XMR) and Zcash (ZEC). Under Article 79, credit institutions, financial firms, and crypto‑asset service providers (CASPs) will be banned from facilitating anonymous accounts or handling privacy coins.

Implementation details—such as how providers must adapt internal processes—are still being shaped through "level‑two" implementing and delegated acts directed by the European Banking Authority.

Moreover, direct oversight will expand: AMLA will begin supervising at least 40 entities from mid‑2027, each with substantial operations across multiple EU states and meeting thresholds such as over €50 million in transaction volume or a minimum of 20,000 clients in a host country. Additionally, mandatory due diligence will kick in for transactions exceeding €1,000.

What This Means for Cyprus

Cyprus, a growing hub for blockchain and fintech firms, will need to ensure its CASPs comply with the new EU AMLR framework. As a result of this elevated regulatory scrutiny, providers offering privacy-coin services or anonymous account access face regulatory constraints that may require operational restructuring.

Additionally, compliance overhaul and cost pressures will arise as firms operating in Cyprus will need to overhaul onboarding, due diligence processes, and privacy-linked services. That may involve investing in enhanced identification protocols—now mandatory for any transactions over €1,000.

Conversely, CASPs that invest early in compliant infrastructure and demonstrate strong AML controls may gain trust among EU regulators and institutional clients. They'll be better positioned to scale under the upcoming AMLA oversight regime as they have done so earlier in 2025 with acquiring MiCA licenses.

Cyprus-based firms may increasingly be evaluated in cross-border AML risk assessments, meaning geopolitical and strategic considerations must be undertaken by foreign companies that also seek MiFID by acquiring these Cyprus-based firms (Figure 1). Ensuring transparency and cooperation with EU authorities could become a differentiating factor in an industry where trust is paramount.

Strategic Opportunity For Cyprus to Bridge Regulation and Innovation

As one of the European Union's most active jurisdictions for crypto-assets, Cyprus stands at a pivotal juncture. There is now a clear avenue for local CASPs and MiCA-licensed entities to redefine their value proposition, shifting toward a compliance-first infrastructure that guarantees both security and programmable transparency.

To achieve this, Cypriot institutions can leverage Porto-style programmable wallets. This technology serves as the connective tissue between MiCA's regulatory framework and AMLR's forensic necessities. It allows for the creation of robust financial products, such as tiered corporate wallets equipped with role-based permissions and automated limits. Furthermore, it facilitates cross-chain settlement with immutable compliance trails, granting regulators real-time visibility into policy enforcement while upholding strict client confidentiality.

In essence, Cyprus is becoming the EU's regulatory sandbox. By demonstrating that compliance frameworks can function in harmony with technological flexibility, Cypriot operators are setting a new standard. As the digital asset market matures, the institutions that integrate policy directly into their wallet architecture will secure their place as the ecosystem's most trusted operators.

During a recent interview with Arthur Firstov, Chief Business Officer at Mercuryo—a payment service provider that enables users to buy cryptocurrencies using fiat currency via various payment methods—mentioned that just as the EU's AMLR forces crypto to mature, Porto, for example, offers the missing architecture to make that maturity functional. When combined with Fireblocks' policy engines, Stripe's Privy infrastructure, and forensic intelligence tools from firms like Crystal Intelligence, Elliptic, or Global Ledger, programmable custody evolves into a full-stack compliance layer.

The post-2027 European market will belong to the firms that can prove trust algorithmically—where every wallet, transaction, and audit trail runs on verifiable logic instead of manual checks. Cyprus, with its fintech density and regulatory flexibility, is well-positioned to pilot that vision. Porto and similar programmable wallet frameworks could make the island not just compliant with EU oversight, but a global benchmark for compliant, composable finance.

Why Forensic Investigations Are Crucial Amid Heightened Regulation

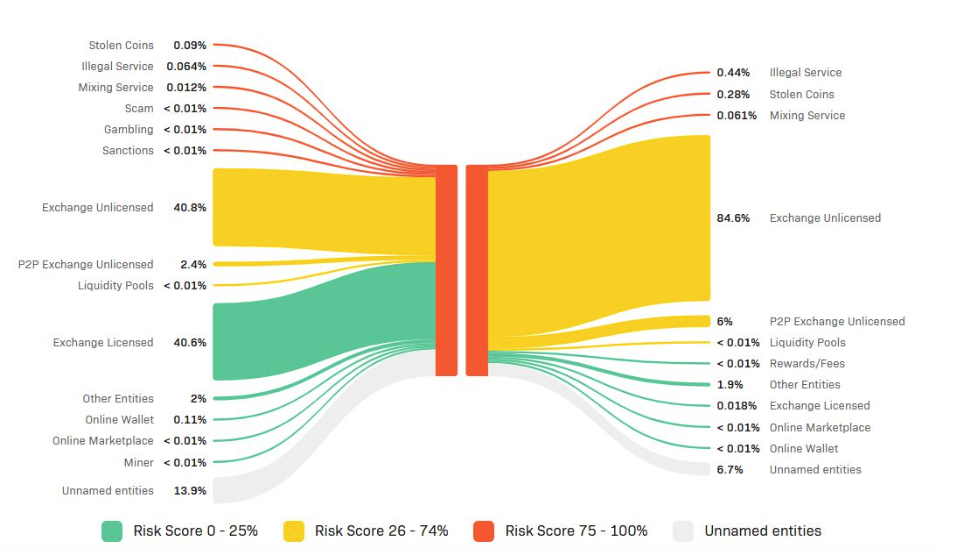

With privacy tokens off-limits and anonymous accounts barred, forensic tools become essential in verifying the legitimacy of historical transactions and distinguishing between compliant activity and illicit flows. For CASPs audited by AMLA or subject to investigations, digital and blockchain forensics provide verifiable audit trails (Figure 2). They strengthen institutional defenses and show transparency to both regulators and clients.

In cases of fraud or unauthorized transfers, forensic analytics facilitate tracing and potentially recovering misappropriated funds—even when obfuscated by privacy-layered mechanisms. As anonymity recedes as a feature, user and investor confidence will lean heavily on forensic transparency. Firms effectively leveraging forensic capabilities can position themselves as secure and accountable.

Precision Forensics for a Regulated Future

In light of evolving EU AML mandates and the phasing out of privacy tokens, the role of forensic investigations cannot be overstated. Ondology Labs offers specialized digital forensic services and blockchain investigation frameworks that directly address these new regulatory challenges.

With expertise in endpoint investigations, onchain tracing, and legally robust chains of custody, Ondology Labs equips exchanges, fintech firms, and regulators to reconstruct complex transactional narratives—even when privacy-enhancing technologies were previously employed. Their blend of technical precision and compliance-readiness makes them an ideal partner for any entity operating under the AMLR's upcoming obligations.

The EU's 2027 ban on anonymous accounts and privacy tokens marks a pivotal shift in crypto regulation—aimed at enhancing transparency and combating illicit finance. For Cyprus, the mandate presents both compliance challenges and opportunities for leadership. Against this backdrop, forensic investigations emerge not only as instrumental tools for compliance and accountability but also as foundations for trust in a privacy-curtailed era.

As the crypto ecosystem adapts, partnering with expert forensic firms like Ondology Labs can mean the difference between regulatory entanglement and responsible, resilient growth.